2025 Irs Limits For Hsa

Blog2025 Irs Limits For Hsa - What are the hsa contribution limits for 2025? For 2025, individuals under a high deductible health plan (hdhp) have an hsa annual contribution limit of $4,150. Individuals can contribute up to $4,150 to their hsa accounts for 2025, and.

What are the hsa contribution limits for 2025? For 2025, individuals under a high deductible health plan (hdhp) have an hsa annual contribution limit of $4,150.

Fsa 2025 Contribution Limits Clara Demetra, The hsa contribution limit for family coverage is $8,300. For 2025, individuals under a high deductible health plan (hdhp) have an hsa annual contribution limit of $4,150.

What are the Contribution Limits for an HSA?, Employer contributions count toward the annual hsa contribution. Individuals can contribute up to $4,150 to their hsa accounts for 2025, and.

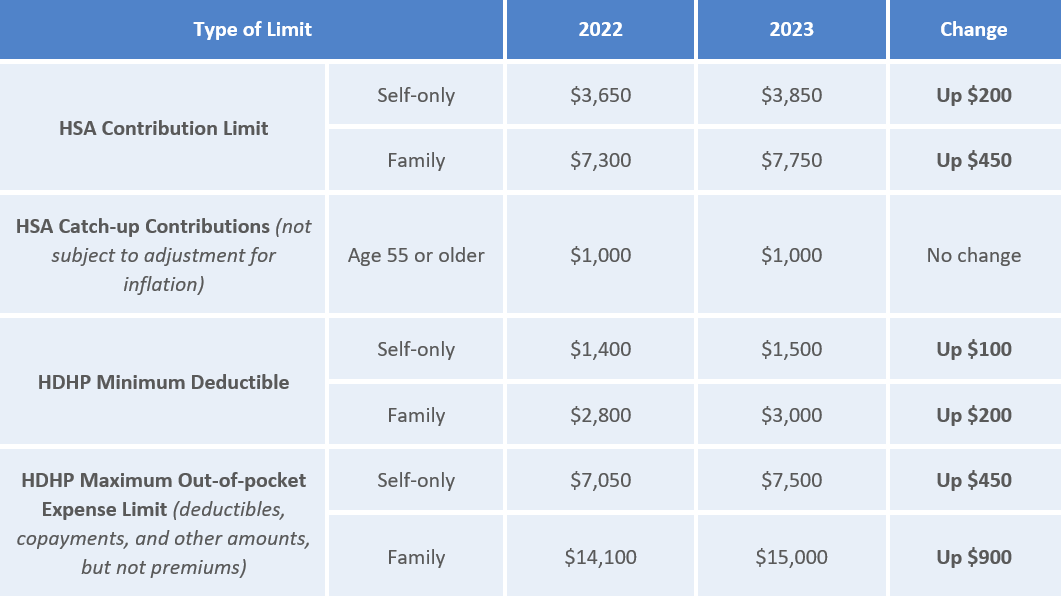

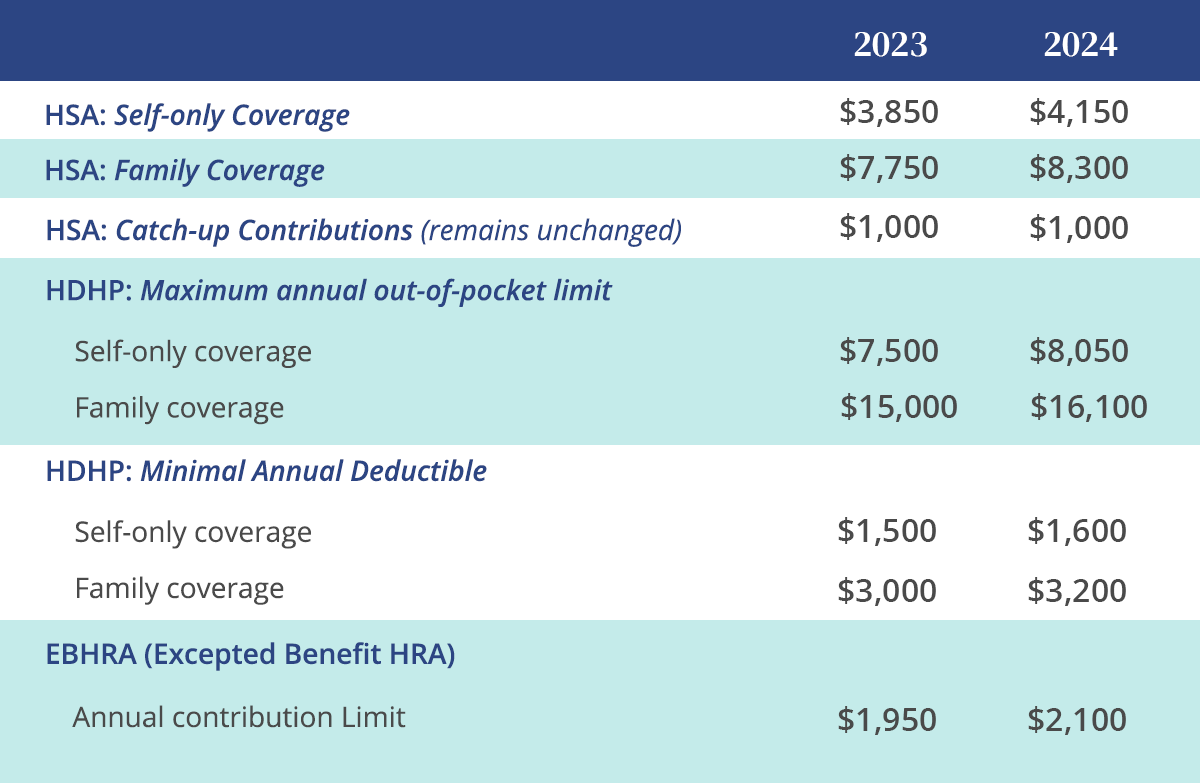

The hsa adjustments for individuals jumped 7.8% for 2025 compared to the previous year and increased 7.1% for family contributions, representing a $300 and $550.

IRS Announces 2025 Limits for HSAs and HDHPs, Use this information as a reference, but please visit irs.gov for the latest. The maximum amount of money you can put in an hsa in 2025 will be $4,150 for individuals and $8,300 for families.

Maximum Contribution For Hsa 2025 Nevsa Adrianne, The irs announced one of the most significant increases to the maximum health savings account contribution limits for 2025. Individuals can contribute up to $4,150 to their hsa accounts for 2025, and.

Significant HSA Contribution Limit Increase for 2025, The irs announced one of the most significant increases to the maximum health savings account contribution limits for 2025. What are the hsa contribution limits for 2025?

Hsa 2025 Family Limit Ciel Melina, What to know about the ‘significant increase,’ says advisor. The irs announced one of the most significant increases to the maximum health savings account contribution limits for 2025.

2025 Irs Limits For Hsa. If you have family coverage, you can. In may, the irs announced a significant increase to the annual hsa contribution limit for 2025.

IRS Raises HSA Contribution Limits for 2025 Due to High Inflation, The 2025 hsa contribution limits are as follows: $8,300 ($550 increase) 2025 inflation adjusted.

2025 Contribution Limits Announced by the IRS, Use this information as a reference, but please visit irs.gov for the latest. $4,150 ($300 increase) family coverage:

Use this information as a reference, but please visit irs.gov for the latest.

IRS Announces HSA Limits for 2025 Crippen, The maximum amount of money you can put in an hsa in 2025 will be $4,150 for individuals and $8,300 for families. In may, the irs announced a significant increase to the annual hsa contribution limit for 2025.

HSA/HDHP Contribution Limits Increase for 2025, The hsa adjustments for individuals jumped 7.8% for 2025 compared to the previous year and increased 7.1% for family contributions, representing a $300 and $550. The 2025 hsa contribution limits are as follows: