Irma Amounts For 2025

BlogIrma Amounts For 2025 - Irmaa 2025 Brackets And Premiums Chart Pdf Row Hyacinth, Irmaa represents the additional amount that some people might have to. Medicare 2025 IRMAA Brackets Amounts and How to Forecast for Retirement, Understanding the 2025 irmaa brackets:

Irmaa 2025 Brackets And Premiums Chart Pdf Row Hyacinth, Irmaa represents the additional amount that some people might have to.

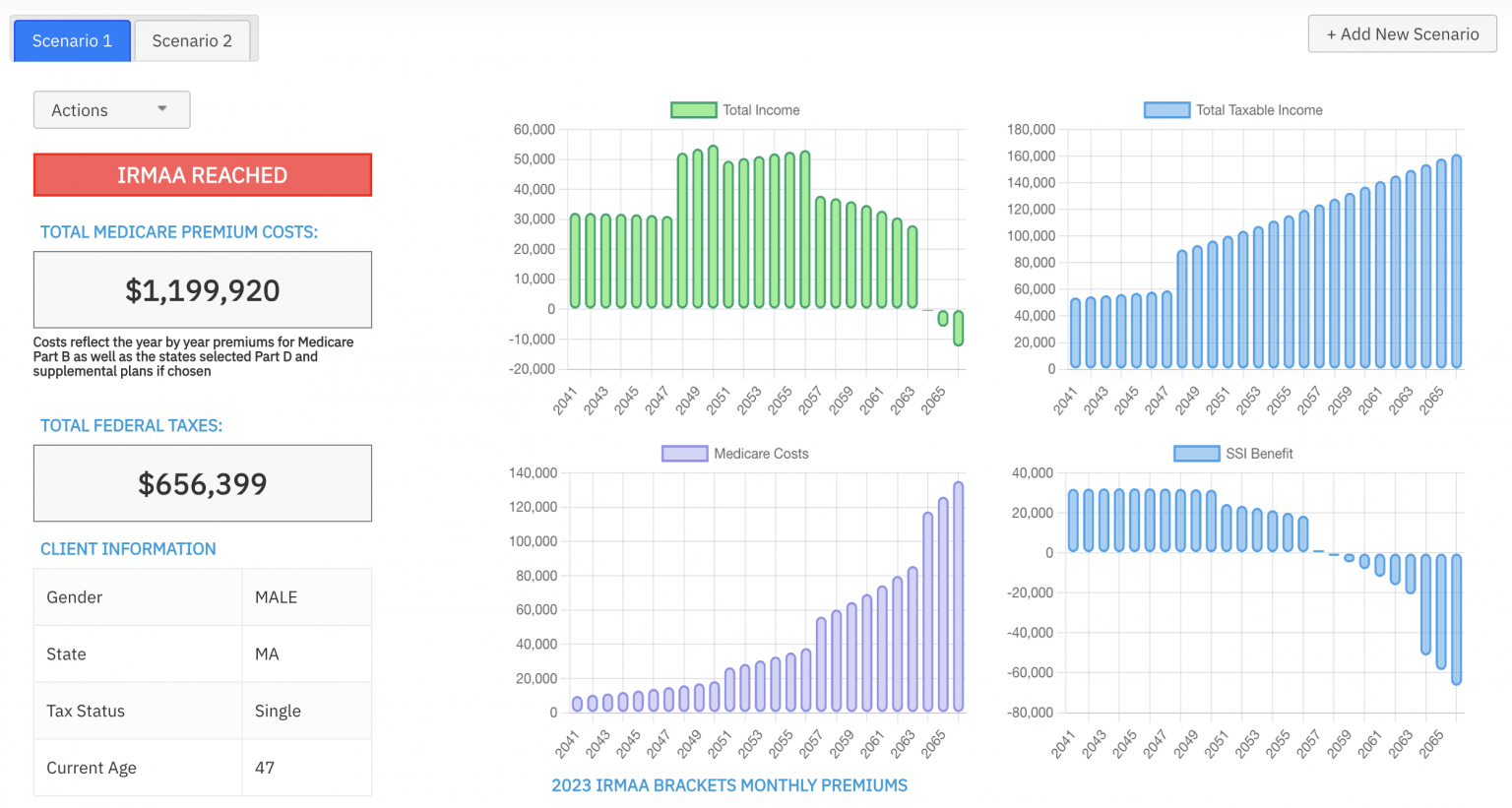

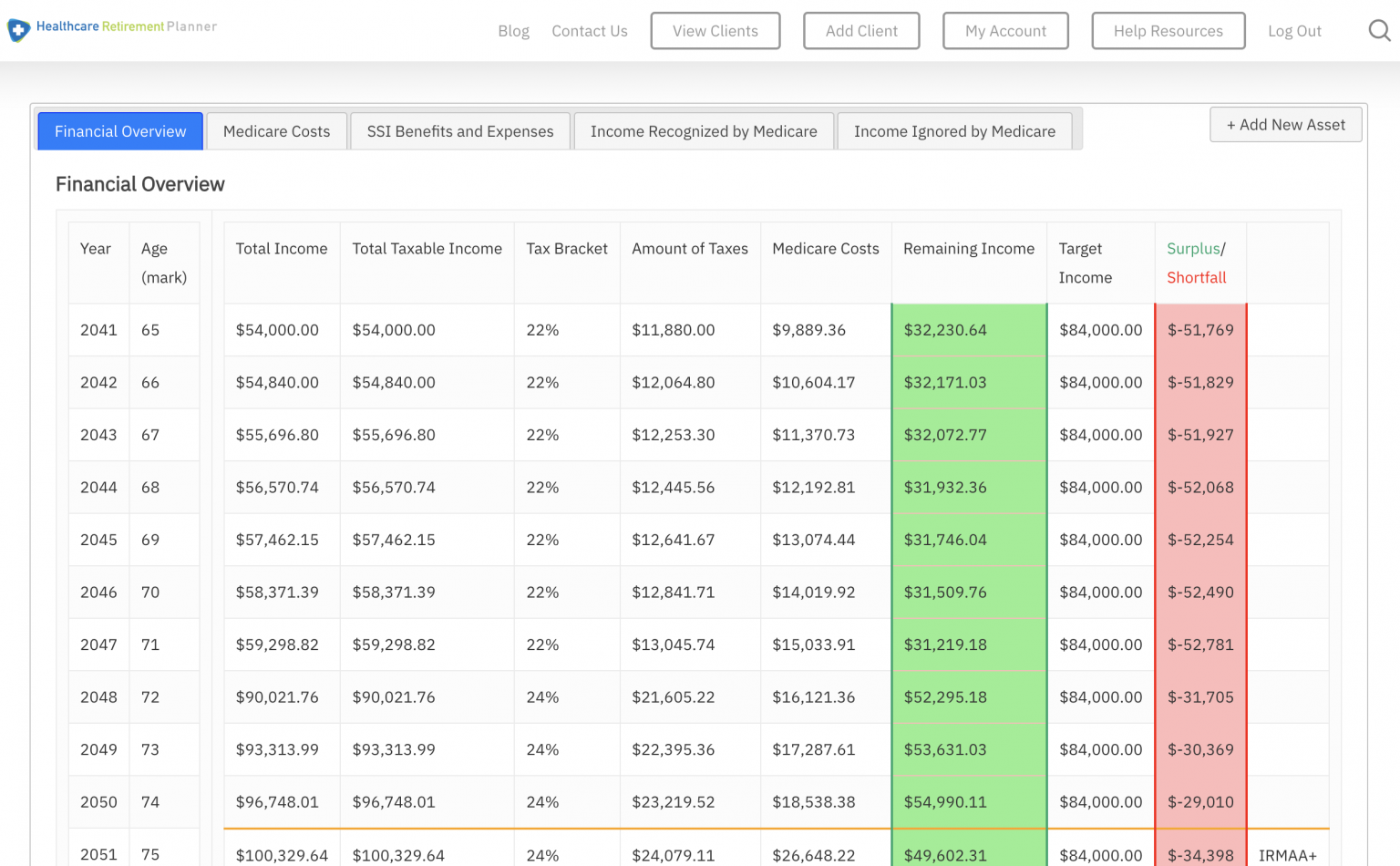

Medicare 2025 IRMAA Brackets Amounts and How to Forecast for Retirement, Policy for irmaa medicare part b and prescription drug coverage premiums sliding scale tables.

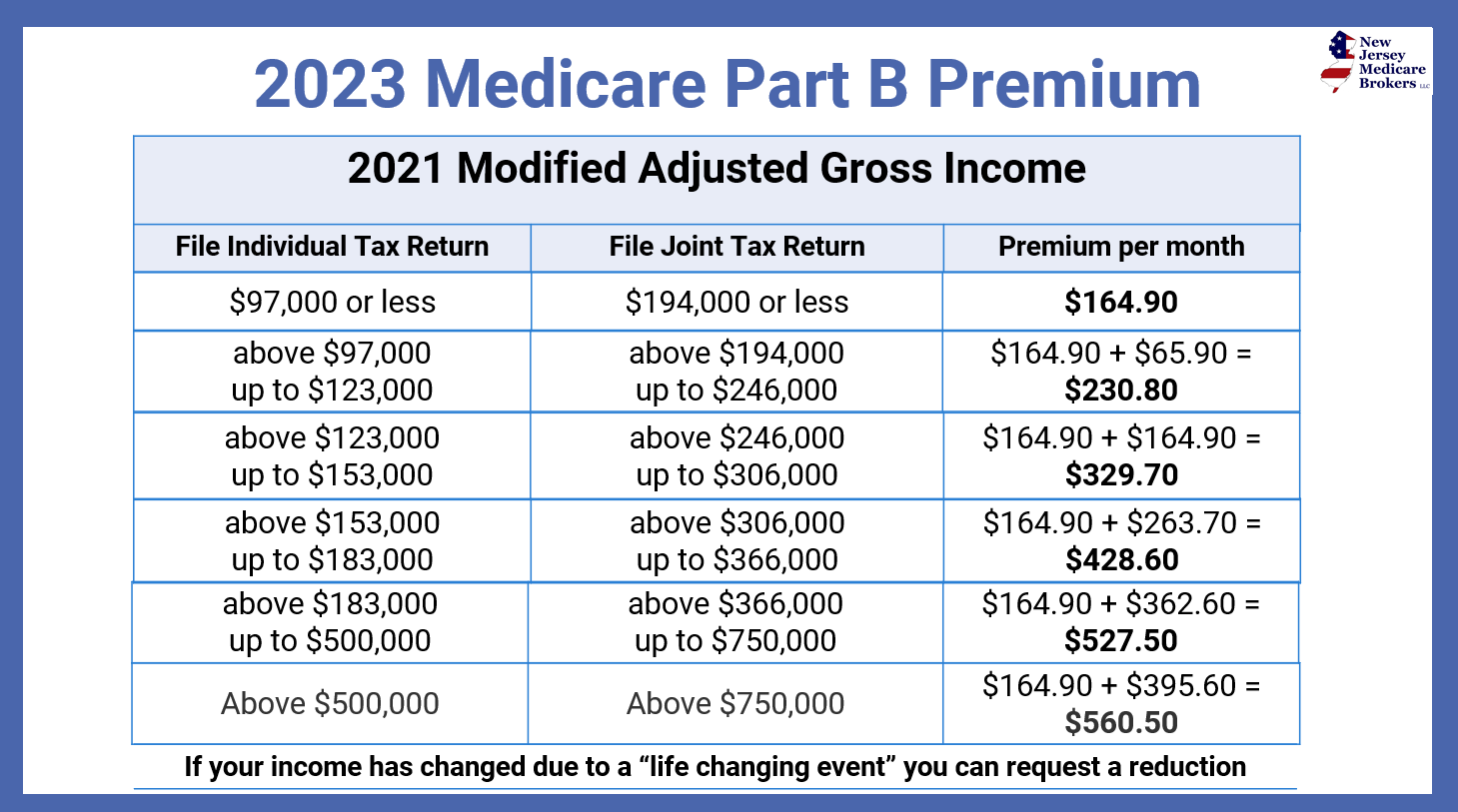

Irma Amounts For 2025. For 2025, beneficiaries whose 2022 income exceeded $103,000 (individual return) or $206,000 (joint return) will pay a total premium amount ranging from $244.60. The amount you’ll pay for your medicare premiums in 2025 hinges on your modified adjusted gross income (magi).

Irma Brackets 2025 Liva Bellina, The irmaa tiers for medicare part b determine the amount of the surcharge based on income levels and tax filing statuses.

Medicare Part B Premium 2025 Cost Chart, Higher income medicare beneficiaries pay more for medicare part b and part d premiums.

The IRMAA Brackets for 2025 Social Security Genius, Irmaa is a surcharge added to your medicare parts b and d premiums, based on income.

Medicare Costs 2025 Chart Hot Sex Picture, In this post, i will cover the 2025 irmaa brackets and how they could affect your medicare part b and d premiums, even if you don’t currently fall into the high.

Irmaa Brackets 2025 Pdf Dulcia Robbie, Your medicare irmaa amount in 2025 is determined by your reported income in 2022.

Medicare Part D Irmaa 2025 Chart Mina Suzann, Irmaa is a surcharge added to your medicare parts b and d premiums, based on income.

Irmaa Brackets 2025 Medicare Nance Valenka, Policy for irmaa medicare part b and prescription drug coverage premiums sliding scale tables.

In this post, i will cover the 2025 irmaa brackets and how they could affect your medicare part b and d premiums, even if you don’t currently fall into the high. The income limit for irmaa in 2025 is $103,000 for individuals and $206,000 for couples.